28+ deduct interest on mortgage

The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Web Important rules and exceptions.

Mortage Interest Deduction What Is The Mortgage Interest Deduction

Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan.

. Register and Subscribe Now to Work on Pub 936 More Fillable Forms. The most that could be deducted for debt before 2018 was. Discover Helpful Information And Resources On Taxes From AARP.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Further mortgage payments and taxes. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Nedage are filing a joint tax return. Complete Edit or Print Tax Forms Instantly.

Ad Access Tax Forms. Web 2 days agoYou cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Web Most homeowners can deduct all of their mortgage interest.

Web For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000. If you took out. Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid.

Mortgage interest paid on a home is also deductible up to certain. Web Mortgage points are considered. While listing their deductions they find that they can deduct 2150 from medical bills 826 from state.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. If you are single or married and.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Also if your mortgage balance is. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. However higher limitations 1 million 500000 if. Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus.

Homeowners who bought houses before. Web 2 hours agoMr. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

That cap includes your existing mortgage balance one vacation or second. Web An equitable owner can deduct interest paid on a mortgage even if they are not directly liable for the debt. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web You are able to deduct the mortgage interest on either your primary residence or second house. 13 1987 your mortgage interest is fully tax deductible without limits. Web Keep in mind that mortgage points arent the only deduction you can claim as a homeowner.

Web If you took out your mortgage on or before Oct. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Best 20 Loan Amortization Schedule Templates Excel Free Best Collections

Treasury Reserve Royal Bank Of Scotland

Hustleit Com H U S T L E I T Twitter

Mortgage Interest Deduction How It Works In 2022 Wsj

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

G49371mmimage003 Jpg

Mortgage Interest Deduction A 2022 Guide Credible

How Is Mortgage Interest Calculated Mojo Mortgages

Mortgage Interest Tax Deduction What You Need To Know

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

April 2010 Association Of Dutch Businessmen

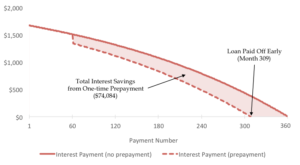

How Does Prepaying Your Mortgage Actually Work Sensible Financial Planning

Mortgage Interest Deductions 101 What You Should Know Daily Podcast Youtube

Mortgage Interest Deduction How It Works In 2022 Wsj

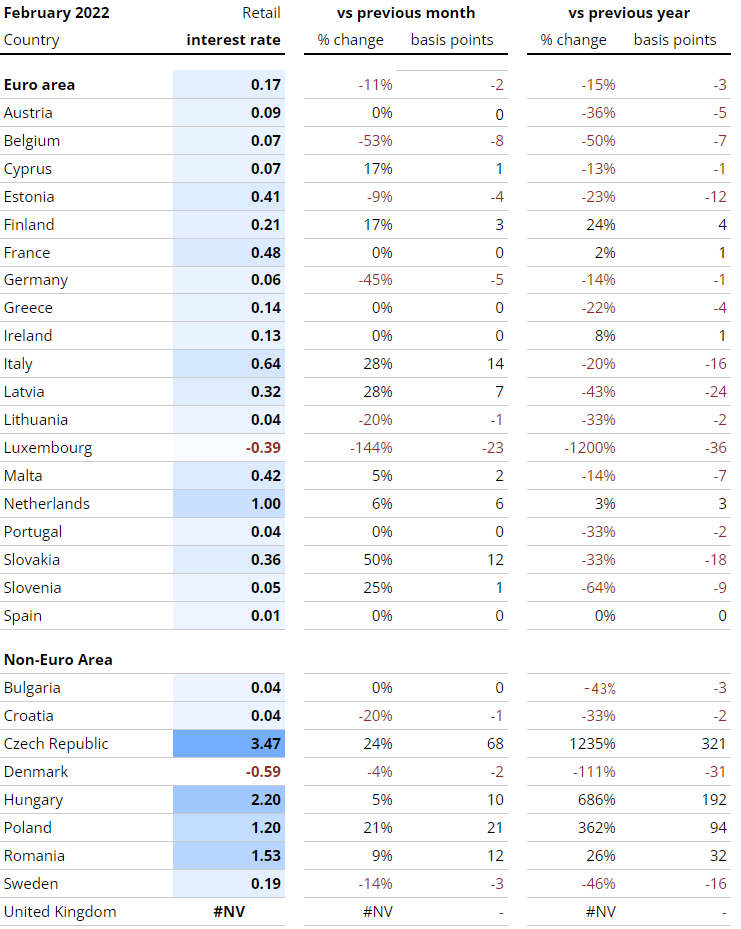

Interest Rates Explained By Raisin

Ftpartnersresearch Insurancetechnologytrends Pdf Patient Protection And Affordable Care Act American Government

Keep The Mortgage For The Home Mortgage Interest Deduction